7 Reasons Why Your FinTech Startup Needs Visual Marketing

- (Source: CompareLand)

When technology fuses with financial services to deliver unparalleled efficiency, a FinTech company is born. In a short number of years, the FinTech industry has flourished by no bounds. With a global investment of $49.7 Billion between 2010-15, it is not surprising that financial technology is one of the most-watched sectors of the economy right now.

In an industry as specialized as FinTech, there is bound to be a mushrooming of niches. According to the EY GFSI Journal, FinTechs are combining innovative business models and technology to enable, enhance and disrupt financial services.

This means that for every need that a customer might have, no matter how small, there is a product ready to satisfy it. This also means that every customer will have too many choices and too less information to make an informed choice. If a customer has a problem, it is likely that they are on the hunt for a quick fix and they definitely do not have time to seek out and spend hours understanding the various FinTech products on offer. What startups need to capture markets full of such consumers is a perfect balance of push and pull strategies.

So how can a FinTech startup with an excellent product successfully reach out to customers? Well, that is where visual marketing comes in.

While it might seem justified to focus all your energies towards the core business, here are a few reasons why your FinTech business will excel by just devoting an iota of those energies towards visual marketing.

1. Quick, Crisp Information Dissemination

Consider this—a person wants to know more about a concept. She has two options—a two-minute video that shows her all that there is in a jiffy or a twelve-page document that will probably take hours to completely understand. Want to wager which option she will choose?

After all, time is money, right? And the less time prospective customers spend understanding your concept, the more money you earn. Visuals are processed 600,000 times faster than text and less is clearly more when it comes to attracting customers.

Make customers understand your FinTech concept in mere minutes through visual marketing

Everyone understands that PayPal is a brand in the payments industry but do consumers actually realise how many more ways they can use the service in and add value to their lives? PayPal’s ‘New Money’ campaign explained its story so effortlessly within 1 minute with the help of this video.

2. Make A Lasting Impression

Humans are visual beings and we remember 80% of the things we see, as compared to all other stimuli. Taking the visual approach to marketing ensures that your brand reaches the visual memory of your target audience and stays there. Visual marketing is known to boost brand recall and retention in its unique way.

Visual marketing makes sure viewers have your FinTech brand on their minds

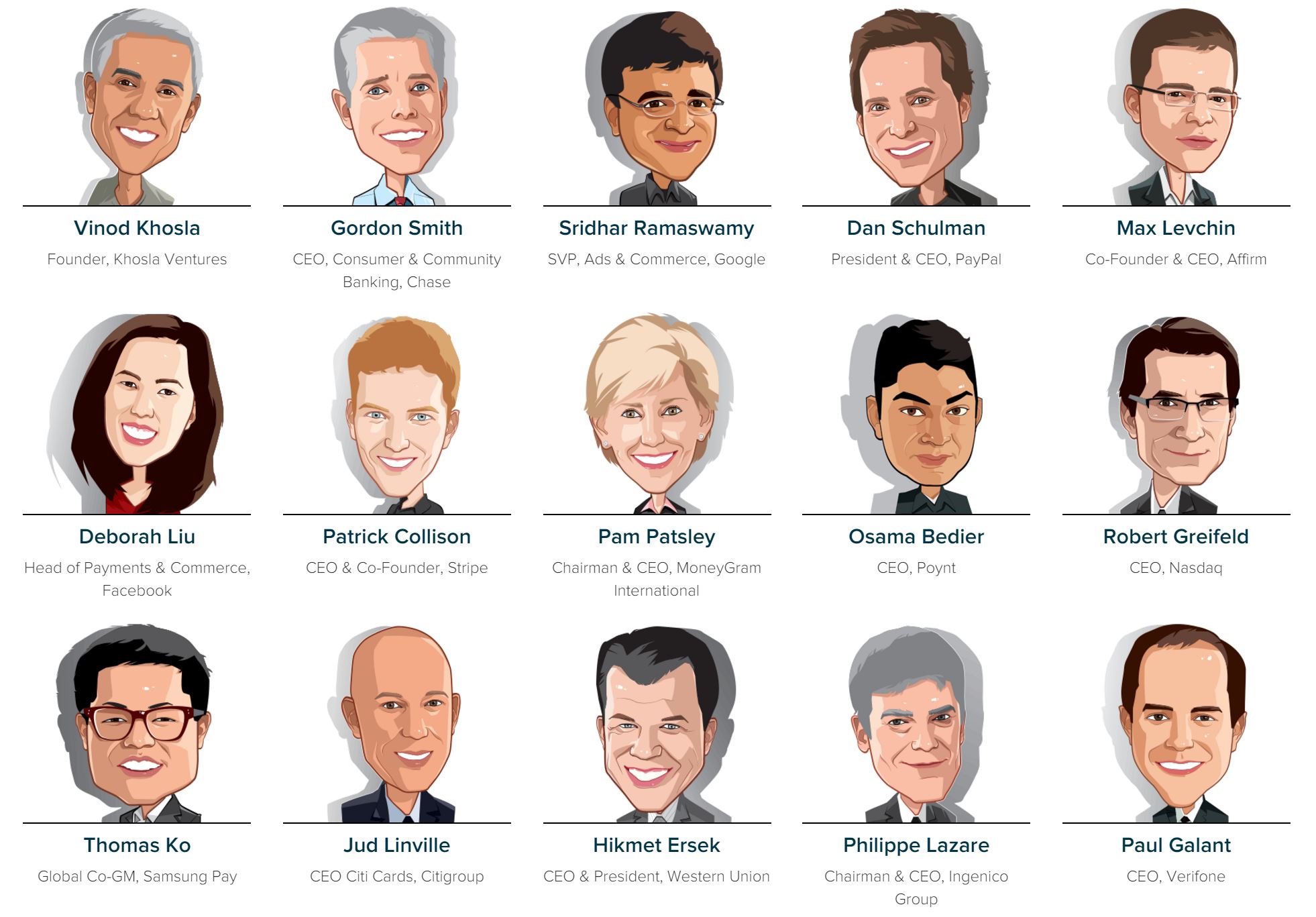

At the Money 20/20 conference, which is the largest global event focused on payments and financial technology, an interesting marketing stunt was observed. Comic caricatures of industry leaders led to the creation of a common visual language within the Money 20/20 community and offered a fresh perspective on the pioneers of FinTech.

For a FinTech startup, it’s not only about attracting customers, it’s also about keeping them interested. That’s where brand recollection and identity become really important. Visual marketing plays on human characteristics and tendencies—that’s why it is so effective, it really connects. Let’s consider an alternative perspective here. Brand recall is obviously important for customers but let’s not undermine its importance for investors and venture capitalists. If you’re a FinTech startup looking for funding, it is imperative to establish and project your brand as one which stays uniquely in the minds of the investor, no matter how many similar ventures he/she is bombarded with.

3. Simplify Your Business Concept

Financial technology is a new, budding sector. Most consumers aren’t familiar with it or even if they have heard of it, they find it too intimidating, comprehension-wise. Let’s face it, FinTech is an amalgamation of finance and technology—two fields which are highly technical on their own. Moreover, because of the complex nature of FinTech products, a customer might turn away from a brand whose processes require a lot of effort to understand and be drawn to a brand that sounds easy and welcoming, even if it means losing out on a product that is perfect for him/her. This is especially true for B2C Fintechs.

Explain even the most complicated of FinTech concepts easily with visual marketing

The best way to fall into the favoured category of FinTech brands is to project an easy, approachable image. A well-executed infographic or explainer video can pave that path for you and make your FinTech business stand out from the rest. These elements of visual marketing can take the focus away from the complex jargon and processes and direct the viewer’s attention towards the real value that lies in your startup.

(Source: BertaViaggiWise)

TransferWise is one of the most popular FinTech businesses since its inception in 2011. It is a ‘peer-to-peer money transfer service’ that makes payments (especially those in foreign currencies cheaper). A customer who is new to the world of FinTech might have numerous questions upon hearing this—How does it work? How is it so cheap as compared to banks? Is it reliable? What do existing users think of it?

TransferWise really exhibited the wisdom it talks about in its name by launching this explainer video- The New World of TransferWise to answer all of the questions above which has 1,063,927 views on YouTube.

4. Capture The Power Of Youth

According to EY GFSI Journal’s report, the first group of customers to adopt FinTech offerings were young, high-income individuals. This means that the younger part of the demographic is already intrigued by and open towards the FinTech industry. Their attention just needs to be zeroed in on your business. With an appetite for adventure, the 18-30 age group also has another preference—creativity over convention. It is safe to assume that reaching out to these consumers will have to be through an innovative pathway that appeals to their mindsets.

(Source: SBS)

The popularity of YouTube and Instagram amongst the youth leads us to one thought—they respond better to visual communication. They are more likely to click on an explainer video or infographic than a huge research document. In order to draw this segment of consumers towards your FinTech business, a great product or service is not enough. They need to be shown why the product is so great and how it can add value to their lives—all in 140 characters. Okay, fine, that is only limited to Twitter but the challenge of brevity remains and it is one that visual media can take care of, with ease.

5. Actual Results: Conversion & ROI

If you’re in the FinTech industry, it is understandable that you trust numbers more than words. Let’s talk numbers, then.

51.9% of marketing professionals worldwide name video as the type of content with the best ROI. (Source: DWS)

People are 85 percent more likely to buy a product after viewing a product video. (Source: Imgur)

Including video on a landing page can increase conversion rates by 80%.

50% of executives look for more information after seeing a product or service in a video.

65% of executives visit the marketer’s website and 39% call a vendor after viewing the video. (Source: Hubspot)

Long story short, visual marketing boosts conversion multifold at a reasonable cost!

A one-time investment in a visual marketing campaign yields results for a considerable period of time. It not only drives actual conversion but also gets people talking about your business. In the long run, the investment in a visual marketing campaign delivers far more than it costs.

(Source: DispatchesEurope)

In addition, visual content builds trust. We consider statistics reliable because they quantify claims and statements of brands. The same applies to visuals—infographics, gifs and videos are much more trustworthy then words. They show what the product or service really looks like and how the brand has evolved over the years.

6. Harness The Power of Visuals on Social Media

Attract, impress and retain customers through a strong social media presence fueled by visual marketing

It is a common perception that social media is a marketing arena more suited to quirky, creative businesses and not the FinTech industry. That’s not true at all considering that the real financial technology users spend huge chunks of their time online on Twitter or Facebook.

(Source: The Next Web)

In Carlisle and Gallagher Consulting Group’s report, it was found that out of 1,000 customers surveyed, 87% thought that banking institutions’ use of social media was boring, uninteresting and slightly annoying. Social media audiences are clearly looking for engaging, relevant and appealing content. A great way to connect all three with your brand is by making use of visual marketing strategies.

If you ask any marketer what the ultimate goal of any business on social media is, the simple answer you’ll receive is ‘engagement’. With visual posts garnering 650 percent higher engagement than text-only posts, it’s evident that gaining and maintaining followers on social media is much easier when the elements of visual marketing are employed.

Consider these stats:

# eMarketer reports, Facebook posts from brands that included images earned 87 percent of all engagements.

# According to Buffer, tweets with images earned up to 18 percent more clicks, 89 percent more favorites, and 150 percent more retweets. (Source: Inc.)

While social media might not be a key focus area for most FinTech companies, its power should not be underestimated particularly when it comes to startups. A strong online presence can do wonders for building a customer base and really help a FinTech startup take off.

7. Beating Competition: Local & Global

The FinTech industry spans over a wide range of subsets including crowdfunding (such as Kickstarter, IndieGoGo and GoFundMe), payments (like Xoom and Paytm), data collection, education lending, credit scoring (for example, ZestFinance and ClearScore), thematic investment and cyber security. The FinTech network is spread across countries all over the world which means that new competitors are added every time the network expands.

By finding and expressing your FinTech’s unique identity through visual marketing, you are not only a league apart from your local competitors but also one step ahead of the global ones.

Leave competitors behind by adding visual marketing to your FinTech’s arsenal

(Source: KPMG)

Visuals are also versatile and can easily be adapted to different languages and cultures. The same visual marketing campaign can help you reach out to customers in different countries. For customers, benefit is benefit, no matter which currency it concerns.

Bottom Line

A multi-faceted tool, visual marketing can really enhance the value of a FinTech startup. Whether you’re looking to secure funding, widen your customer base or beat competition—visual marketing is a unique solution to all. More and more FinTechs are adopting this strategy and seeing astounding results. Want your FinTech startup to soar new heights? Well, get the conversation started on your very own visual marketing campaign today!

Subscribe to Crackitt's Visual Marketing Workshop

Get exclusive visual marketing lessons and business growth hacks right inside your inbox.